What are the tax and investment considerations for a Granny Flat above versus a Tiny Home below? Income Tax Return Reporting - Income Streaming Tiny Homes Tiny home ownership does not have to follow the ownership interest of the underlying property ownership. For...

SMSF Investment Property

Investment Property

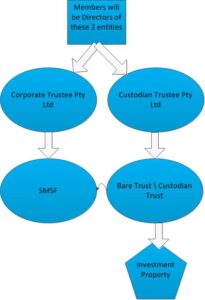

Buying an investment property in your Superannuation Fund will require the setup of a Bare Trust structure where the Trustees have decided to purchase a property with loans. The typical structure is set out below:

The SMSF can invest in commercial or residential property, but this can’t be your personal residence. You can’t have any dealings with a related party when investing in residential property. So you can’t live in the property, use the property as a holiday house or have a family member live in it. It should be for the sole purpose of investing in your SMSF.

Some important points regarding the use of an SMSF for property investment are as follows:

- To invest in property, it is important to set up the SMSF first, including the structure above. An SMSF itself can’t borrow money, and therefore a Bare Trust structure is put in place to facilitate the loans

- The sole purpose of the Bare Trust (also referred to as a Property Trust) is to keep title over the investment property until the loan is paid off

- All property-related costs can be paid by your SMSF

- Your SMSF receives rental income and pays for all operating expenses and loan repayments

- Only one property can be added to a structure like this

- The property will revert back to your SMSF when the loan is repaid

- Funds can be borrowed from the Trustees or the bank, or any combination of yourself and the bank

- The loan type a bank would give the SMSF is called a limited recourse loan, meaning the bank does not have recourse on the SMSF should the loan default

- For this reason, banks usually ask for a personal guarantee over the property from Trustees

- The maximum Loan to Valuation Ratio (LVR) is usually around 80% with residential properties and 70% with the commercial property when members guarantee the loans

- When there’s a bank loan and a 60% LVR, the bank might not require guarantees from Trustees

- The lender to the SMSF can be you as the Trustee if you prefer not to use a bank

- Trustees can borrow from the bank and then on-lend to the SMSF – this option might make the administration easier

- The Bare Trust and Corporate Trustee are merely legal entities for holding the property and all transactions take place in the SMSF

- There is a setup cost, extra to the basic setup of the SMSF, to cover the setup of the Bare Trust.

Your SMSF normally cannot incur any loans. To purchase a property, your SMSF can use a Limited Recourse Borrowing Arrangement. This is where the Trustees would provide a guarantee to the bank for the loan. Trustees can use a mortgage broker to help them find the best suitable loan for their circumstances from a panel of lenders.

When we set up a Limited Recourse Borrowing Arrangement for an SMSF, we issue a new Trust Deed. This will make the loan approval process at the bank a smooth process.

Repair and Maintenance

When repairs and maintenance are undertaken in an investment property, these costs can be deducted from the SMSF. See these guidelines from the ATO for the difference in repairs vs. improvements.

What name should the SMSF use with property investment?

Use the Custody / Bare Trust’s name, for example:

• if individual trustee “John Summers ATF ABC Custody / Bare Trust”

• if corporate trustee “ABC Pty Ltd ACN number ATF ABC Custody / Bare Trust”

Land registries generally do not accept any reference to a Custodian / Bare Trust. Therefore, the transfer of land should simply be registered in the custodian’s legal name, for example:

– when the SMSF uses an individual trustee, use the names of the individuals e.g. “John Summers and Sarah Summers”

– when the SMSF uses a corporate trustee, use the name of the corporate trust, e.g. “ABC Pty Ltd ACN number”