What are the tax and investment considerations for a Granny Flat above versus a Tiny Home below? Income Tax Return Reporting - Income Streaming Tiny Homes Tiny home ownership does not have to follow the ownership interest of the underlying property ownership. For...

Enquire Now

Before sending an enquiry, you can check if your your question may be answered already in our Frequently Asked Questions below

Send an Enquiry

Frequently Asked Questions

How do I make an appointment?

I'd like to talk to someone before booking?

Best to complete the above enquiry form above, and we’ll respond ASAP. Also, feel free to explore our website and read some of our insights (blogs), you may find the information you are looking for!

All the appointment options are listed on the Book Appointment Page.

All appointments are via self-booking, no need to talk to anyone to book a time that suits you.

What are the prices for tax returns or for property tax advice?

Please click on the Services Tap at the top of the website to see our standard prices.

Property Developers, Flippers, NDIS SDA, or SMSF clients, can also consider booking a free scoping meeting to see if we are a good fit to manage your ongoing property tax accounting.

How do I know if you are a good property accountants?

Good questions, many accountants are “jack of all trades”, while I, “Garry Wolnarek” specialise in Property Tax and Advice.

Garry has personally completed thousands of rental property tax returns, and provided advice over 20+ years, through a number of property cycles.

Garry our principal loves property, and our mission is to continually keep abreast of all things happening in the property world.

I just want to speak with someone and ask a quick property tax question?

We find that most people that have an initial question lead to various other issues connected that may come into play, or need to be considered to answer that quick question.

We can’t give answers on the fly, and we have a duty of care to understand your background, to understand if anything else needs to be considered.

Most property questions involve properties with values in excess of $500,000, the implications of getting the wrong advice can incur you tens of thousands of dollars, in extra taxes, stamp duty, land tax, and GST.

Generally, there is no such thing as a quick question, trust us!

What if after the meeting you're only telling me what I already knew, what am I paying you for?

Knowledge is power, and having the assurance that your assumptions are correct will give you the confidence to invest or enter into property contracts, to buy, sell, subdivide, renovate, and develop.

What price do you put on avoiding a costly tax mistake? that could cost you ten’s if not hundreds of thousands of dollars now and into the future!

Do you know how NDIS SDA works for tax?

Yes, we have a number of clients that are involved in buying and constructing NDIS SDA properties to rent to NDIS participants

We can advise on the –

- GST

- Appropriate Tax Structure to use – (ie) company, trust, SMSF, etc

- Provide ongoing tax and accounting advice.

- https://www.umbrellaaccountants.com.au/ndis-sda-residental-investment-properties-are-gst-free-how/

We are looking for advice around property developments, can you help?

Yes, we have extensive experience with advising clients on all the various tax issues around property developments

See also our page for Property Developer Tax Planning Page

I like to consider buying property in a SMSF, can you help?

Yes, we have extensive experience with advising clients on all the various tax issues around buying properties in an SMSF

We can advise on:-

- Setting up and running an SMSF

- how to borrow money via a Property Bare Trust

- how to buy multi properties

- rolling over industry super funds into your SMSF

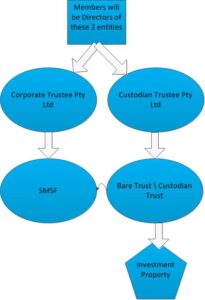

Bare Trust Structure

SMSFs can invest in commercial or residential property; however, neither Trustees nor related parties are permitted to live in the property or use the property as a holiday house. The sole purpose of the property must be as an investment of your SMSF.

Some important points regarding SMSF property investment:

- It is important that the SMSF, including the structure above, is set up before you invest in any property. An SMSF can’t borrow money in its own right; hence, a Bare Trust structure must be put in place to facilitate the loans.

- The only purpose of the Bare Trust (also referred to as a Property Trust) is to keep title over the investment property until the loan is paid off.

- All property-related costs can be paid by the SMSF.

- The SMSF receives rental income and pays for all operating expenses and loan repayments.

- In this particular structure, only one property is allowed.

- The property will revert back to the SMSF when the loan is repaid.

- Funds can be borrowed from the Trustees or the bank, or a combination of both.

- The loan type a bank can offer the SMSF is known as a limited recourse loan. Limited recourse means that, should the loan default, the bank has no right of recourse on the SMSF’s other assets.

- For this reason banks usually ask for a personal guarantee over the property from Trustees.

- With member-guaranteed loans, the maximum Loan-to-Valuation Ratios (LVRs) are usually around 80% for residential properties and 70% for commercial.

- When there’s a bank loan with a 60% LVR, the bank may waive the requirement for a guarantee from the Trustees.

- Trustees can also lend to the SMSF, so it’s possible to do it without a bank.

- Trustees can borrow from the bank and then on-lend to the SMSF – this tends to make the administration easier.

- The Bare Trust and Corporate Trustee are merely the legal entities that hold the property – all transactions take place within the SMSF.

- Umbrella Property Accountants charges a one-off fee to set up these entities, after which there is no additional fee for their maintenance (it’s included in your fixed monthly fee).

GST Margin Scheme Advice, can you help?

Yes, we have extensive experience with advising clients on all the various tax issues around property development, GST and if and how to use the GST Margin Scheme.

GST Margin Scheme for Property Developers

We can advise on:-

- If you are eligible for the GST Margin Scheme

- On the purchase or sale of land

- New Property Development Sales

I need to amend my tax return

OK, please complete the enquiry form so we can contact you to set up the most appropriate method to complete the amendment.

Do you do Small Business Accounting and Bookkeeping?

We work with our sister company – Umbrella Accountants to support our clients with:-

- Bookkeeping

- Payroll

- Bas Lodgement

- General Small Business Accounting

www.umbrellaaccountants.com.au